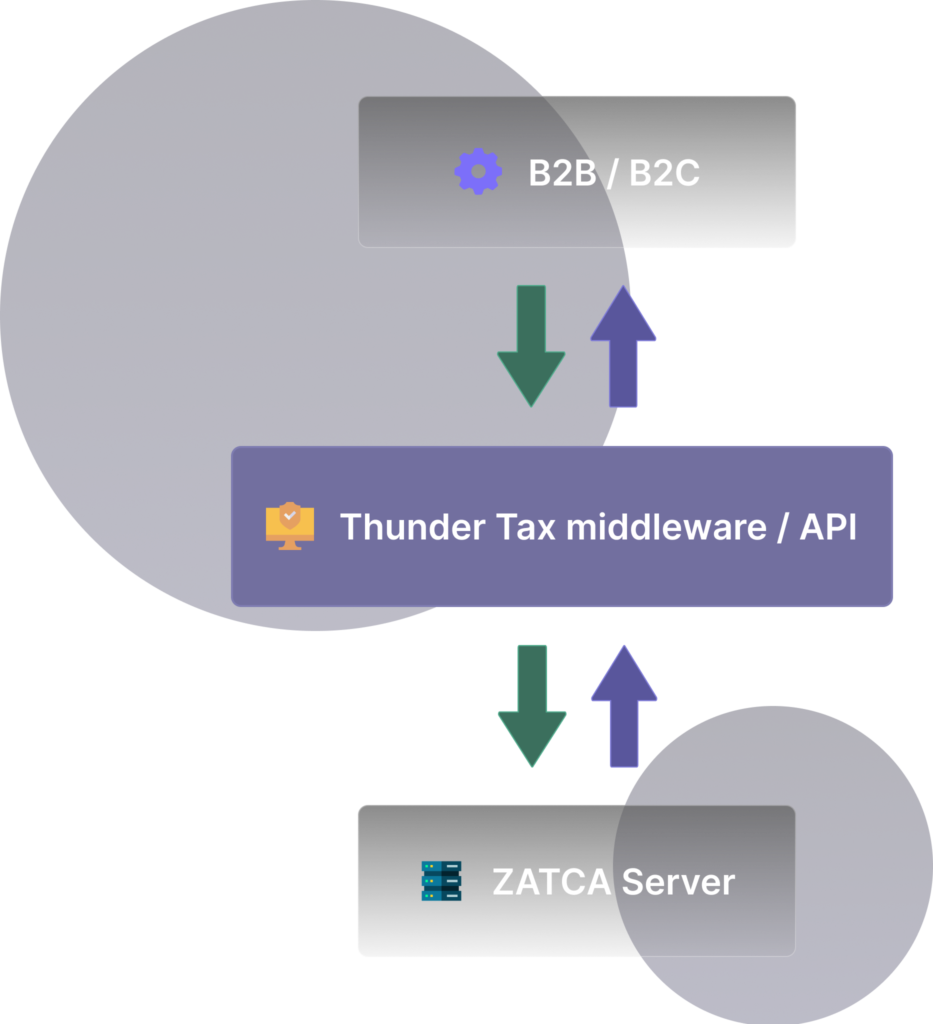

Find the right solution based on your needs -B2B, B2C & SaaS. Data will be stored in KSA located servers.

Our APIs manage the entire communication process between your ERP/POS systems and the ZATCA platform, ensuring 100% law compliance.

Thunder Tax's solution is compatible with any ERP/POS, allowing integration with numerous systems simultanenously.

Thunder Tax provide 24/7 tailored customer service.

Unprecedented Speed. Impeccable Reliability.